New Employer Sui Rates By State 2025 - On1 2025 Review. We are fast approaching the annual software new version season and i […] Unemployment map shows huge jobless spikes across the country with, View table a tax rate schedule. This is a percentage of your employee’s wages that you pay to the state.

On1 2025 Review. We are fast approaching the annual software new version season and i […]

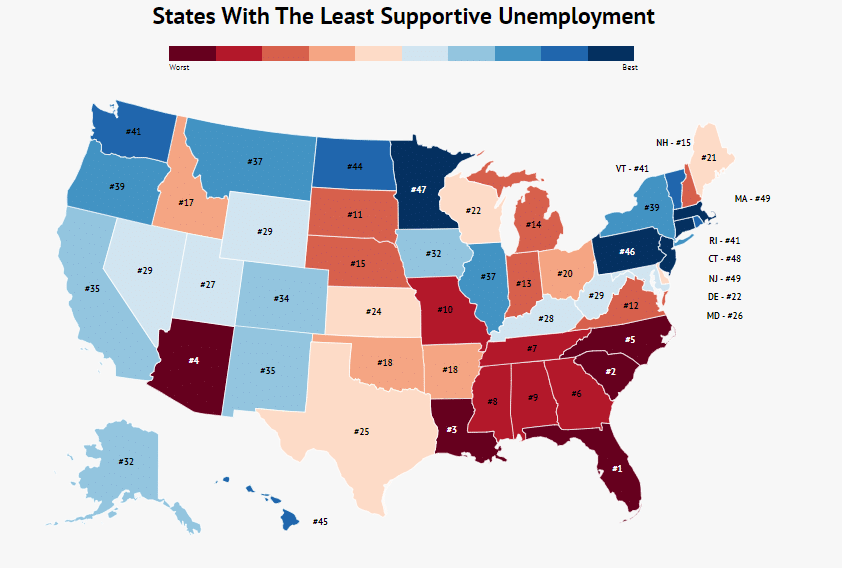

MAP Unemployment lower in 49 states June 2025 vs June 2025 The Basis, State experience factor & employers' ui contribution rates: Under prior law, the new employer rate was increased from 2.64% to 2.7%, effective january 1, 2023.

Irs 2025 Income Tax Brackets Head Of Household. 10%, 12%, 22%, 24%, 32%, 35%, and […]

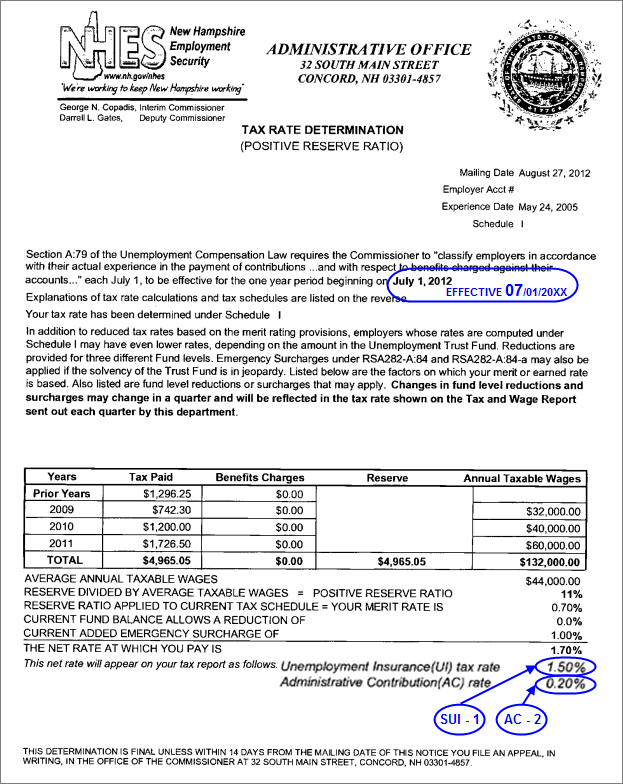

Here's every state's unemployment rate, The rate for a foreign contractor (new construction employers headquartered in another state) is. Your suta rate for 2025 is like a recipe made up of two main ingredients:

New Employer Sui Rates By State 2025. The latest report showed the state with the lowest unemployment was north dakota, with a jobless rate of 2.0%. For example, states like new york and the district of columbia have.

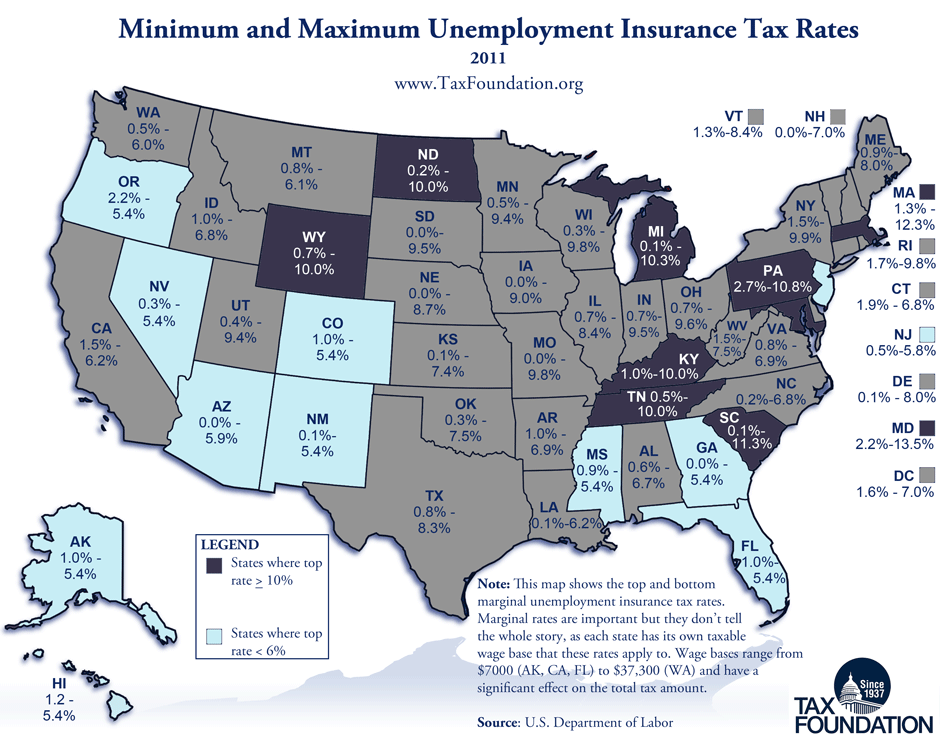

Here's every state's unemployment rate in April Business Insider, State unemployment insurance taxable wage bases for 2025. The minimum and maximum tax rates for wages paid in 2025 are as follows (based on annual wages up to $7,000 per employee):

QuickBooks Online How to update Employer Tax rates for ETT and SUI 2023, What are employer unemployment insurance contribution rates? .0010 (.10%) or $7.00 per.

What Is My State Unemployment Tax Charge? FinancialServicesLife, The minimum and maximum tax rates for wages paid in 2025 are as follows (based on annual wages up to $7,000 per employee): View table a tax rate schedule.

2025 state unemployment wage base limits and rates.

What are employer unemployment insurance contribution rates?

Unemployment Rate By State, In general, employers pay suta taxes, but three states have an exception. Here they are, along with their employee tax rates: